- Solar Photovoltaics

- Market Analysis

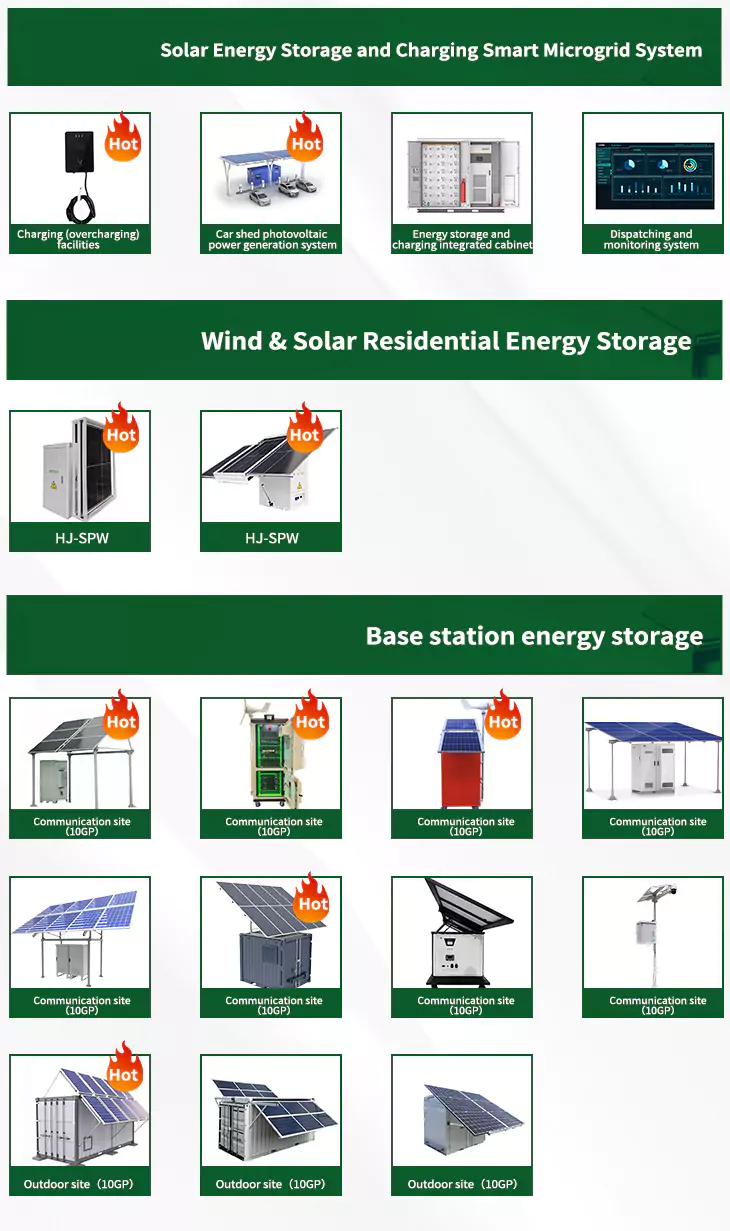

- Storage Systems

- Policy & Regulations

- Case Studies

- Innovation & Research

- Solar Energy Applications

- Battery Management Systems

- Grid-Connected Systems

- Smart Home Integration

- Off-Grid Solutions

- Renewable Energy Policy Trends

- Energy Conversion Technologies

- Solar Panel Technologies

- Energy Distribution

- Solar Water Heating Systems

- Waste-to-Energy Systems

- Energy Efficiency Improvements

- Wind and Solar Synergies

- Advanced Materials for Energy

- Energy Financing & Investment

- Electric Vehicles and Charging Infrastructure

- Geothermal and Solar Integration

- Carbon Capture & Sequestration

- Solar Energy Research Initiatives

- Environmental and Social Impact